Oil, Profits and the need for change

3rd November 2023

Yesterday Shell announced their interim profits of £5.1bn for the period July to September. This was up on the previous quarter but down compared with this quarter last year when their profits were over £7bn.

According to a report made by Reuters, in order to compete with its fellow oil producers, Shell will be aiming to increase its dividend by 20% and to make overall payouts of between 35-40% of its cash flow. To this end the new CEO Wael Sawan aims to maintain Shell’s oil output at 1.5 million barrels per day. While this is less than the 2.6 million bpd produced in 1998, Sawan’s plan is to maintain this 1.5 million bpd until 2030! With oil prices again rising due to the conflict in the Middle East, increasing profits and dividends seem secure – and Sawan has said that shifting to a low-carbon economy cannot come at the expense of profits. (1)

The Guardian has reported that Shell plans to invest $40 billion in oil and gas production between now and 2035, and between $10bn and $15bn in “low-carbon” products including biofuels and carbon capture. (2) Carbon capture is important to Shell as it aims to reduce its carbon emissions between now and 2050. However it must be noted that Shell only includes scope 1 and 2 emissions in these targets – ie they intend to reduce the emissions arising from the production of oil and gas, with for example carbon capture being used to offset emissions they cannot remove. What is not covered in Shell’s net zero aspirations are the emissions released by the oil and gas once they have been sold and used – scope 3 emissions. Other oil companies do the same, each competing to claim whose oil is least carbon intensive or greenest!

In 2022 Shell’s scope 1 and 2 emissions were 58 million tonnes CO2e, but its scope 1,2 and 3 emissions were in the region of 1.6 billion tonnes CO2e. Global emissions for CO2e are about 40 billion tonnes of which fossil fuels contribute about 37 billion tonnes. There is no getting away from the fact that fossil fuels are drivers of climate change. And equally that companies like Shell have no intention of phasing out oil from their business plans.

Meanwhile the International Energy Agency ( IEA) has said that if we are to achieve our net zero emissions by 2050 there must be no more development of new oil or gas. There is already enough fossil fuels available from the existing sites for the world’s economies to use as they transition to net zero.

However oil and gas typically produces a return of 10-20% whilst renewables only yield 5-8%. Our lifestyles are still deeply dependent on the oil economy and often it seems simpler to pay more for the fuel than to readjust tey way we live and work. Equally it would seem that the markets cannot reflect in their prices the risk and/ or cost of a climate catastrophe. Surely then it is time for the markets to be regulated for the benefit of everyone. Such regulations would need to be clear, precise and universal to be effective. Individual nations are unlikely to make such regulations in isolation. Hence the need for regulatory agreements to be reached at, for example, COP28.

It is also important that the nations at COP28 agree to a sharp and complete phasing out of fossil fuels. The agreement will need to clearly define when and how fossil fuel production is to be reduced to zero. It will effect some countries more than others – especially those who have previously become dependant on oil money. It will affect jobs, both those directly employed in the extraction of fossil fuels, and those employed in the processing of this raw material. It will also affect investment markets, potentially reduce the amount of funds accruing to pension funds, insurance companies etc. Ensuring a smooth and fair transition is important.

The IMF reports, “The end of oil thus makes economic transformation imperative. Oil-rich countries must diversify to become resilient to the changes in energy markets. An appropriate governance framework to manage proceeds from oil in good and bad times has always been important to fostering economic diversification. But with stranded assets a new risk, radical shifts in governance in oil-dependent economies are urgent. Dubai, for example, facing the depletion of its oil reserves, transformed itself into a global trade hub. Countries and businesses reliant on these markets must formulate policies to address this transformation, including the development of renewable energy.” (Arezki 2020) (4)

What does not and will not help, is prolonging the viability of oil companies. In particular the use of government subsidies should be withdrawn universally. Instead windfall taxes should be levied to fund reparations to communities disproportionately affected by climate change.

Last year Ethical Consumer reported “Currently, the UK’s tax regime makes it the most profitable country in the world to develop big offshore oil and gas projects. Most spending on oil and gas exploration can be offset against tax, as it is classified as ‘research and development’. Almost all spending on new fields can be offset in the first year of development, and companies can claim tax relief for decommissioning offshore installations. Since the Paris Agreement, the government has provided £13.6 billion in subsidies to the UK oil and gas industry. From 2016 to 2020 companies received £9.9 billion in tax relief for new exploration and production, including £15 million of direct grants for exploration, and £3.7 billion in payments towards decommissioning costs.” (4)

From research commissioned by the Liberal Democrats, the Guardian reported that since 2015, whilst renewable energy received £60bn in subsidies, fossil fuel companies received close to £80bn. (5) No wonder the investment returns on fossil fuels exceeds that from renewables!

And in 2022, Energy Voice reported that “Shell received net rebates of over $121 million (£92m) from the UK government last year, the largest total from any country in which it operates. In total, Shell received rebates of more than $131m (£100m) from HM Revenue and Customs, according to its latest Payments to Governments report, released Tuesday. This was offset by fee payments to regulators, including more than $10.5m (£8m) to the Oil and Gas Authority (now the North Sea Transition Authority), and over $120,000 (£91,000) to the Crown Estate Scotland.” (6) Is the UK government actively paying oil companies to damage our climate?!

The IEA reports “‘The IEA has long advocated removing or at least reducing fossil fuel subsidies because they distort markets, send the wrong price signals to users, widen fiscal deficits in developing economies, and discourage the adoption of cleaner renewable energies. Their expansion is particularly worrying at a time when we should be redoubling efforts to cut wasteful consumption and accelerate clean energy transitions. Reforming prices is a political challenge, but it is also economically and environmentally vital.” (7)

The overarching aim of the climate COPs is to limit the extent of climate change and its impact on the world. To this end numerous agreements have been made since COP21 in Paris in 2015, to reduce net emissions to zero by 2050. This scientists thought would keep global temperature increases below 1.5C. However it now seems that with emissions still rising, we may pass this threshold much sooner. Samantha Burgess, the deputy director of the European Union’s Copernicus Climate Change Service (C3S), noted that September 2023 would be one for the record books. “This extreme month has pushed 2023 into the dubious honour of first place – on track to be the warmest year and around 1.4°C above pre-industrial average temperatures.” (8)

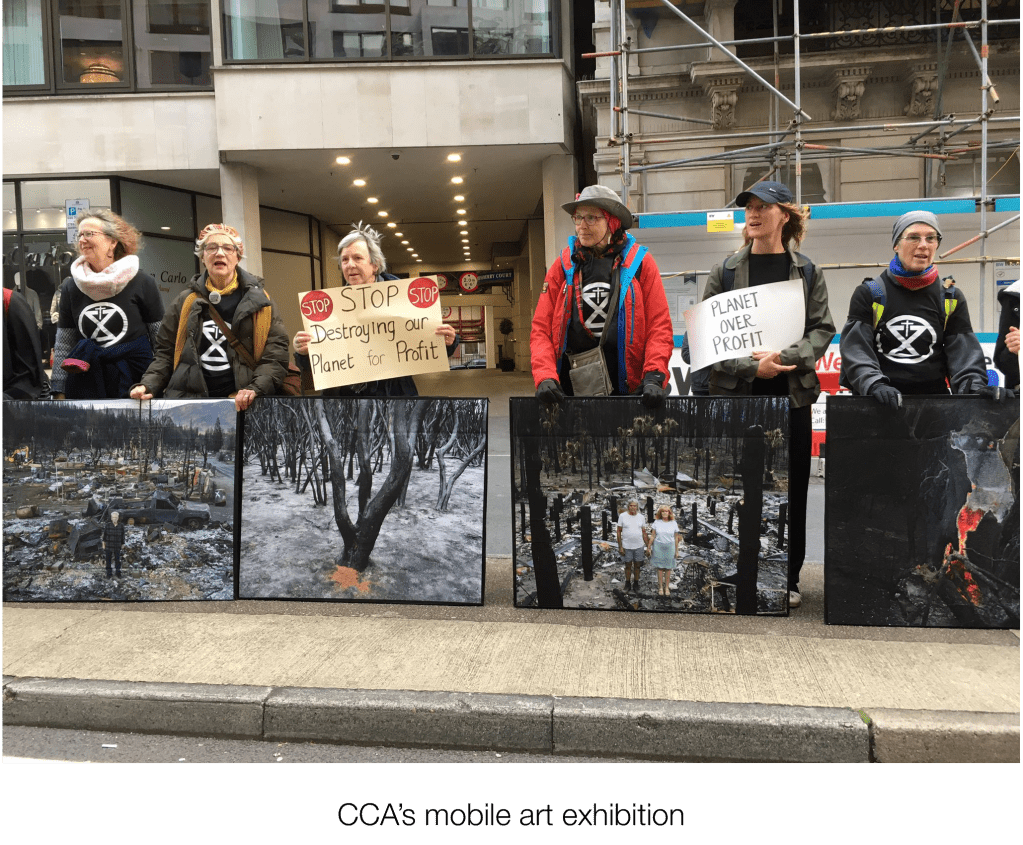

The failure of governments and oil companies to phase down the production of fossil fuels is surely morally if not criminally wrong? In the next Green Tau I will be looking at campaigns and actions that aim to address this.

(1) – https://www.reuters.com/business/energy/shell-pivots-back-oil-win-over-investors-sources-2023-06-09/

(2) – https://www.theguardian.com/business/2023/jun/14/shell-drops-target-to-cut-oil-production-as-ceo-guns-for-higher-profits?CMP=Share_iOSApp_Other

(3) – https://www.imf.org/external/pubs/ft/fandd/2021/06/the-future-of-oil-arezki-and-nysveen.htm

(4) – https://www.ethicalconsumer.org/energy/paid-pollute-fossil-fuel-subsidies-uk-what-you-need-know

(5) – https://www.theguardian.com/environment/2023/mar/09/fossil-fuels-more-support-uk-than-renewables-since-2015

(6) – https://www.energyvoice.com/oilandgas/north-sea/400886/uk-government-hands-shell-more-than-92m-in-2021/

(7) – https://www.iea.org/reports/oil-2021

(8) – https://news.un.org/en/story/2023/10/1141937