3rd November 2024

Is the National Trust Walking the Talk?

The National Trust is the UK’s largest conservation and environmental protection charity with between 6 and 7 million members and is custodian of just under 260,000 hectares of land. One of its two overarching strategic priorities is its ambition of reaching net zero emissions by 2030. It has already met its target of creating and restoring 25,000 ha of new wildlife habitats and is working towards 50% of Trust land being nature friendly, by 2025. It also aims to plant 20 million trees by 2030.(1)

Recognising the scale of the twin crises of climate change and biodiversity loss, and that neither of these recognises boundaries in terms of either cause or effect, the National Trust collaborates with other bodies such as the RSPB and WWF. This trio has produced the The People’s Plan for Nature and the Save our Wild Isles campaign. The National Trust has joined many more groups in supporting events such as the Restore Nature Now March and the March for Clean Water.

Surely the National Trust can be said to be walking the talk?

And yes in so many ways they are, but to quote the UN Secretary General, Antonio Guterres, we must do ‘everything, everywhere, all at once’ if we are to avert the worst of the climate and biodiversity crises.

So what about banking? Over recent years many organisations and individuals have looked at their financial arrangements and divested from fossil fuels – whether that is selling shares directly linked to oil and gas production or withdrawing from pension and investment funds that are reliant on returns generated through the production of fossil fuels. In 2019 the National Trust announced its decision to divest from fossil fuels to safeguard the long term future of the environment.

So what about banking?

Banks are essential to the ongoing production of fossil fuels. Their banking services enable companies, such as Shell and BP, to remain operational and able to continue to develop new oil and gas fields. The annual fossil fuel finance report for 2024, ‘Banking on Climate Chaos’,(2) shows that Barclays is still the eighth largest funder of fossil fuels globally and, once again, holds the number one slot in Europe. In 2023 Barclays supplied the fossil fuel industry with $24 billion.

Clearly who you bank with has an environmental impact element! For individuals several organisations exist – such as Make My Money Matter, Switch It Green and JustMoney (3) – to enable people to review their banking arrangements and to switch to a more environmentally friendly alternative. Other organisations such as Mothertree (4) offer the same service for both individuals, organisations and businesses. Most notably this past year both Christian Aid and Oxfam (organisations with complex banking needs) have dropped Barclays as their bank.

Yet Barclays is the National Trust’s bank.

Not surprisingly, there has been growing pressure on the National Trust to switch to a more environmentally friendly bank. Continuing to bank with Barclays does dint the National Trust’s credibility as a leading conservation and environmental protection charity.

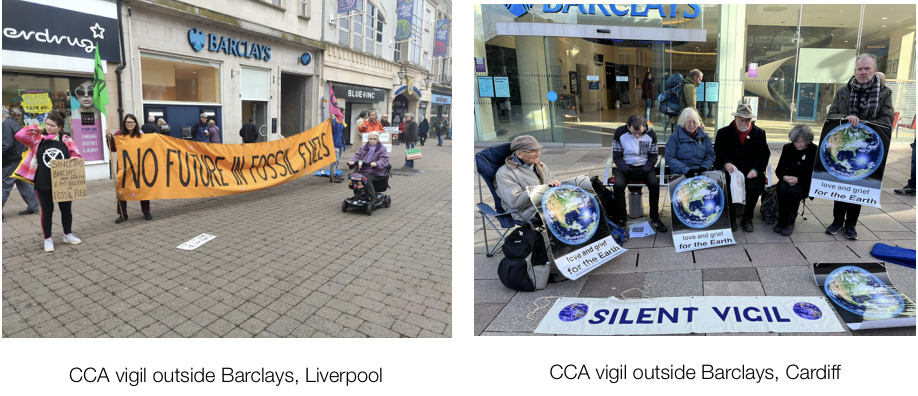

Christian Climate Action has been actively campaigning on this issue for the last three years, attending the National Trust’s AGMs, writing to and talking with people inside the Trust’s organisation.

In July Christian Climate Action, along with other organisations, organised a week of action, targeting National Trust properties with banners and placards, banking-themed picnics, fancy dress, questionnaires, scoreboards, and an online petition calling on the Trust to ‘Drop Barclays’.(5) (Later we learnt that the staff and volunteers were pleasantly surprised at the engaging and friendly approach of the actions having previously experienced more aggressive tactics from other campaign groups).

This year’s National Trust’s AGM was held in Newcastle. A group of us from Christian Climate Action organised a pilgrimage -well equipped with flags, pennants and banners (and flapjack) – that set off from The Sill and walked along Hadrian’s Wall and via the Tyne Valley to Newcastle. On the way we happy band of pilgrims stopped off at National Trust sites – Housesteads Roman Fort, Cherryburn (Thomas Bewick’s birthplace) and the one room dwelling that had been Stephenson’s birthplace.

Up bright and early on the day of the AGM, the CCA pilgrims were joined by other climate activists standing outside the Civic Centre handing out leaflets about the Drop Barclays campaign – and about the equally important Climate and Nature (CAN) Bill campaign. (6) NT staff greeted us with smiles and a genuine interest in what we were doing.

Those who were members with tickets to go into the AGM, were able to have many face to face conversations with Trustees, Council members and members of the executive team, and to talk with them openly on issues related to the climate, environment and biodiversity loss. Altogether there were some 400 National Trust members attending in person, there were a further 3000 who took part on line – and when it came to questions and comments during the AGM, each contingent was able to participate equally. I was surprised that more people didn’t take part. I asked a question in the first Q and A session and thought that I would then have to sit on my hands thereafter to give space to others. But there was no rush of hands so I was able to make a further two comments in subsequent discussions.

There were only two points of contention. One concerned the system of Quick Votes – an issue which had been the basis of an unsuccessful resolution the previous year which was felt by a vocal minority to be undemocratic. The Quick Vote is an option where members chose to follow the position of the Trustees. It is a system used by many organisations with a large membership. It is only an option and members can mix and match the way they vote on the different issues. It does not stifle debate: anyone can still join in the debate regardless of which voting method they have chosen. As the use of the Quick Vote was not a resolution this year (the same topic can not be brought back until three years has elapsed) there was no vote on the matter.

The other issue that produced contentious debate was that of plant based foods. Some members asserted that the proposal forced them to eat food which was not of their choosing, whilst – as the resolution itself highlighted – felt that instead the proposal gave everyone choices about what they ate. Others were concerned about the impact on the Trust’s tenant farmers. The National Trust aims to use local produce and produce from their farms as much as possible – much of the flour used in their cafes comes from wheat grown on the Trust’s Wimpole Estate.

In all three member’s resolutions were proposed, discussed and voted on. One called for an increase of plant based foods in the National Trust’s cafes (from the current 40% to 50%). Another called for the strengthening of the National Trust’s response to climate and ecological emergency, and the third called for the National Trust to give its formal support to the Climate and Nature Bill. All three resolutions were passed with significant majorities – voting included votes cast before the AGM and those cast on the day whether in person or online. Whilst the Trustees are not obliged to adhere to the resolutions, they clearly show the Trustees what topics matter most to the Trust’s members.

I came away from the AGM feeling physically and emotionally drained. I felt taking part had been both important and, as it happened, highly productive. I felt that the pilgrimage had been a good preparation – walking along companions, walking through some of the wonderful landscapes and habitats that we wish to protect and enhance, meeting and sharing with local people, grappling with and overcoming tiredness, and creating the headspace to think clearly and prayerfully.

Our conversations with the National Trust will continue as we both applaud the many good things they do and press them to Drop Barclays.

(2) https://www.bankingonclimatechaos.org/ This report was a joint effort among Rainforest Action Network (RAN), BankTrack, Center for Energy, Ecology, and Development, Indigenous Environmental Network (IEN), Oil Change International (OCI), Reclaim Finance, the Sierra Club, and Urgewald. The finance data was co-researched with significant contributions from Profundo.

(3) https://makemymoneymatter.co.uk/; https://www.switchit.green/; https://justmoney.org.uk/the-big-bank-switch/

(4) https://www.mymothertree.com/

(5) https://christianclimateaction.org/2024/06/08/week-of-action-urging-national-trust-to-drop-barclays/